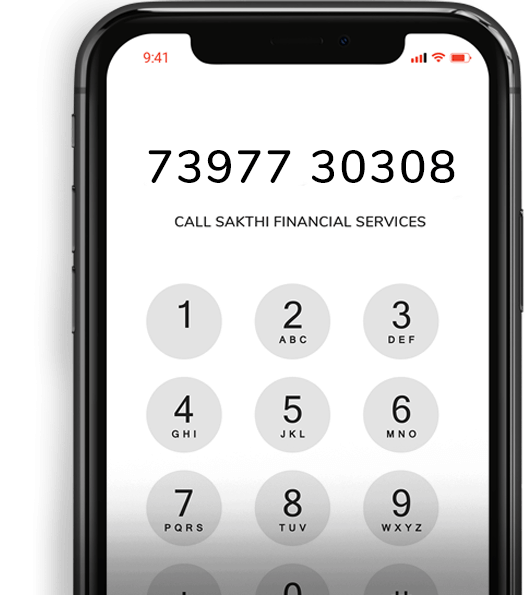

Deposits

Make a Deposit into a Better Tomorrow

Fixed Deposits

Sakthi Financial Services is the only authorised distributor of various Investment schemes offered by Sakthi Finance Limited.

Sakthi Finance Limited has schemes that provide guaranteed returns and security on your investments. With constant price fluctuations and living expenses shooting up each year, it is prudent to have a suitable investment scheme that aims at making the best use of your financial savings and investments. These schemes are built around your preferences, so you get to enjoy a host of features and benefits, making it one of the best decisions you have made on your investments.

If you are looking for deposits for a short term with guaranteed returns, the SFL’s fixed deposit scheme is the one for you. The fixed deposit Scheme lets you take control of your investments with flexibility and offers guaranteed returns.

So why wait? Invest and watch your money grow.

Rs 10,000/-

calculator

Interest Rates

| SCHEME I & II | |||||

| Term (Months) | Fixed Deposit and cumulative Deposit Interest rate p.a. (%) | Fixed Income Scheme | Cumulative Income scheme | ||

|---|---|---|---|---|---|

| Monthly (%) | Quarterly (%) | Annual Yield with Quarterly Rests (%) | Maturity Amount for Rs.10,000 | ||

| 15 | 8.25 | 8.25 | 8.25 | 8.60 | 11,075 |

| 24 | 8.50 | 8.50 | 8.50 | 9.16 | 11,832 |

| 36 | 8.75 | 8.75 | 8.75 | 9.88 | 12,965 |

| 48 | 9.00 | 9.00 | 9.00 | 10.69 | 14,276 |

| 60 | 9.00 | 9.00 | 9.00 | 11.21 | 15,605 |

| Minimum Deposit (₹) | 25,000 | 10,000 | 10,000 | ||

| SCHEME I & II | |||||

| Term (Months) | Fixed Deposit and cumulative Deposit Interest rate p.a. (%) | Fixed Income Scheme | Cumulative Income scheme | ||

|---|---|---|---|---|---|

| Monthly (%) | Quarterly (%) | Annual Yield with Quarterly Rests (%) | Maturity Amount for Rs.10,000 | ||

| 15 | 8.50 | 8.50 | 8.50 | 8.87 | 11,109 |

| 24 | 8.75 | 8.75 | 8.75 | 9.45 | 11,890 |

| 36 | 9.00 | 9.00 | 9.00 | 10.20 | 13,061 |

| 48 | 9.25 | 9.25 | 9.25 | 11.04 | 14,416 |

| 60 | 9.25 | 9.25 | 9.25 | 11.59 | 15,797 |

| Minimum Deposit (in Rs.) | 25,000 | 10,000 | 10,000 | ||

| INTEREST RATES SCHEME 1 : CUMULATIVE NCD | SCHEME 2 : FIXED INCOME NCD | ||||||

|---|---|---|---|---|---|---|---|

| Term (Months) | Interest Rate p.a. | Yield | Interest Rate p.a. | Interest Rate Frequency | Maturity Amount for Rs.50,00,000 | ||

| Monthly | Quartely | ||||||

| 15 | 9.00% | 9.41% | 9.00% | 9.00% | 9.00% | 55,88,388 | |

| 24 | 9.25% | 10.03% | 9.25% | 9.25% | 9.25% | 60,03,432 | |

| 36 | 9.50% | 10.84% | 9.50% | 9.50% | 9.50% | 66,26,695 | |

| 48 | 9.75% | 11.75% | 9.75% | 9.75% | 9.75% | 73,50,443 | |

| 60 | 10.25% | 13.17% | 10.25% | 10.25% | 10.25% | 82,93,579 | |

| Terms & Conditions governing Acceptance of Secured, Redeemble, Non-Convertible Debentures of Rs. 1000/- each | |||||||

Documentation Required

General Guidelines

The deposit cannot be pre-closed before 3 months.

The depositor can pre-close the deposit at any time after 3 months.

If the depositor wants to pre-close after 3 months but before 6-months, then he/she will not get any interest along with the principal.

The depositor is eligible for interest on pre-closure after 6-months as per the terms applicable.

The depositor can avail loan up to 75% on the deposit amount as a loan, the applicable interest rate will be 2% p.a. above the deposit rate.

A deposit can have a maximum of three co-applicants.

Nomination facility is available. If the nominee is a minor, then the guardian can sign on behalf of the minor.

TDS will be deducted from interest on deposits if the depositor is a tax payee.

KYC for all applicants of the deposit is mandatory. The depositor has to obtain CKYC number after submitting relevant KYC documents to the company.

HDFC Deposits

We are happy to announce distribution of HDFC FDs, which will add to our bouquet of products to our customers.

In the current market scenario, there is lot of traction for monthly income/higher fixed income products. Keeping this in view, we have empanelled with HDFC Ltd. to distribute their FD products.

HDFC has delivered consistent performance with its Fixed Deposits over the last 35 years. It has earned the trust of more than 6 lakh depositors. Enhanced customer satisfaction has always been at the core of all HDFC product offerings. HDFC depositors are serviced through its 420 inter-connected offices spread across India with instant services provided at 77 deposit centers. HDFC has set high benchmarks of service delivery on a continuous basis by providing electronic payment facility for interest payment, instant loan against deposit and many more.

HDFC FDs will provide our customers a fixed income product with a wide option of tenors and interest rates.

Pre-closure of FDs is possible, and the conditions are called out here for your special attention

FAQs

- 1 Is TDS applicable on FDs?

- Yes, tax is deducted at source, from the interest on Fixed Deposits, as applicable, as per the Income Tax Act, 1961.

- 2 What are the multiples in which I can withdraw money from my FD?

- You can withdraw money in multiples of Rs 1000/-

- 3 Can I redeem my FD before the original term?

- Yes, but a premature withdrawal is subject to a penalty rate as prescribed by the organization.

- 4 Can I obtain a loan from SFL on the security of my FD?

- Yes, loans are available.

- 5 Is there any auto renewal facility available on FDs?

- No, auto-renewal facilities are not available.

- Upon maturity of FD, just furnish the FD receipt and you will be able to redeem your FD.

- Yes, you can nominate your family members or individuals.