Mutual Funds Investment offers the perfect solution for a group of investors to effectively pool their money, and invest in a wider variety of securities facilitated by expert fund managers. Mutual fund companies essentially collect the money from their investors or shareholders and invest that collective money into best investment schemes and individual investment vehicles based on risk profiles, money management philosophies, and financial goals among their important factors.

Mutual funds then pass along the profits (and losses) of the mutual funds investment to its shareholders. Mutual funds normally come out with several mutual fund schemes that are launched from time to time with different mutual funds investment objectives.

Invest and Monitor the performance of your mutual funds through our “MyWealthBridge” portal or app.

We are a AMFI ( Association of Mutual Fund in India) Registered MF Distributor vide ARN : 82174 since 03-Mar-2014. Current validity of ARN is 02-Mar-2026. We provide investment services to our clients, incidental to our primary activity.You can check the list of all mutual funds where we are acting as a distributor – fundlist.

We do not charge any advisory fees or transaction fees – directly or indirectly, because we earn commission from the funds which we distribute. You can check the commission disclosure sheet here at Commission Disclosure. Although we take our best attempt to ensure the suitability of the product being sold to you, but the same may not always be in the best of your interest.

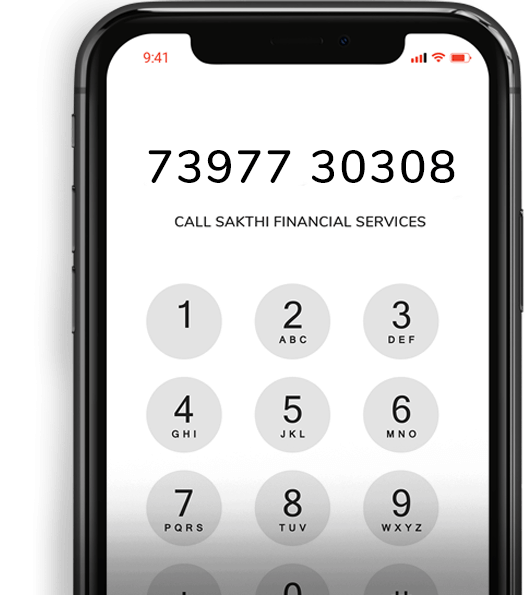

Grievance Redressal : Contact person – Mr M.DEIVANAYAGAM | Phone – 9944980453 | Email - mf@sfsl.in