Why should one invest in SGB scheme rather buying physical gold?

- Eliminate risk & storage expenses

- No risk involved in terms of purity & making charges in the case of gold in jewellery form

- Attractive Interest Income, directly credited to investor's bank account

- Avail discount of Rs.50/gm for applications made online and payment through digital mode

- Encashment/Redemption of the bond is allowed after fifth year. It is also tradeable & transferable if held in demat form

- The SGB bond acts as security collateral to avail loans

- Capital Gains are eligible for tax exemption

- Flexible & safe payment options are available to subscribe to the scheme

Sovereign Gold Bonds Issued by Reserve Bank of India on behalf of the Govt of India.

| Eligible Investors | Individuals, HUFs, Trusts, Universities, Charitable Institutions |

| Tenure | 8 years |

| Investment Limit | Min.of 1 Gram to Max. up to 4 kg for Individuals per year. Up to 20 kg for Institutions (Trust, Charitable institutions & Universities per year) |

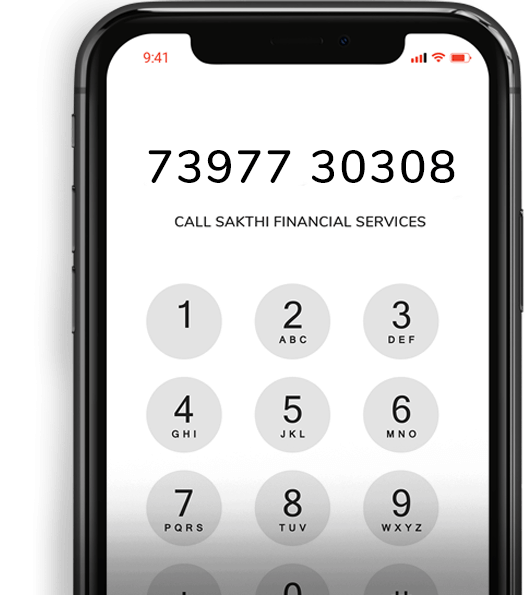

Apply Now