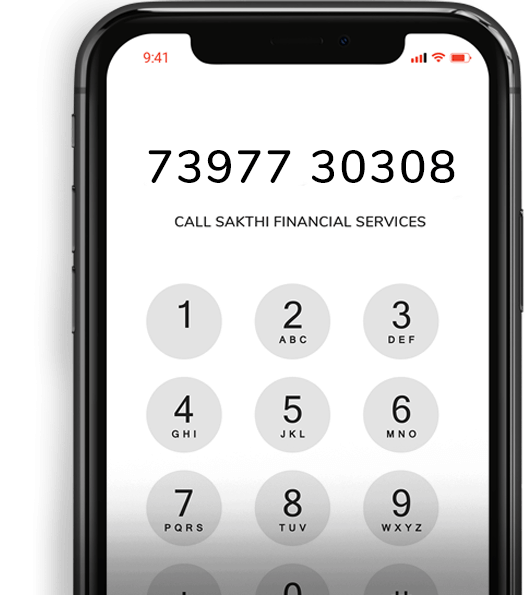

Invest in SIP

Plan an SIP along with your Home loan EMI

It helps you retire your loan easily.

Apply Now

Your goal of buying a new car, going on a family vacation to a dream destination, or owning a bigger house and more is possible only if you plan proactively to achieve them. A Systematic Investment Plan(SIP) is one of the most beneficial ways of investing in Mutual Funds. SIPs help to instill financial discipline and create wealth for the future. With SIPs, you can start investing a minimum amount in the best mutual funds in India and gradually grow a corpus in a planned and systematic way. Invest in SIP today and achieve your goals readily.

What is a Systematic Investment Plan?

A Systematic Investment Plan or SIP is an investment mode through which you can invest in the best mutual funds in India. As the name suggests, it is a systematic method of investing a small pre-determined sum of money in the market at regular intervals. The intervals can be monthly, quarterly, or semi-annual.

When you invest in SIP steadily, it is easier to fulfill your financial dreams. The SIP type mutual fund investment is renowned among investors who look to invest in mutual funds and stocks because it enables you to participate in the market while handling risk better.

How does SIP work?

When you invest in SIP, you invest a fixed sum of money that lets you purchase a certain number of fund units in a given period. If you keep doing this for a long time, you get to invest in the fund during the lows and highs. It does not require you to time the market to make your investments. The market timing is always a risky proposition as you are supposed to be investing at the wrong time. But, the factor of unpredictability gets removed when you choose to invest in SIP.

After choosing the best SIP to invest in, you can decide the tenure and frequency and automate your investments. Provide a standard instruction to your bank to take a fixed amount directly from your bank account and invest in a SIP mutual fund of your choice, on a set date monthly or quarterly, etc.

How SIP can help you retire Home Loan easily?

If you are planning to take or have already taken a home loan to buy your dream house, you will have to pay the cost of interest for the loan. But you can recover the entire amount when you invest in SIP for home loans. However, this is possible only if you show interest in investing and demonstrate patience throughout time.

A Systematic Investment Plan or SIP can help you reach various financial goals, helping you to save on your home loan interest. Many house-owners have taken home loans to purchase their properties. Generally, this type of loan comes with the Equated Monthly Installments or EMI, the sum you pay every month for the bank to repay your loan.

The EMI option comprises a principal component and an interest component. The amount you have borrowed is known as the Principal component. For instance, if you have got a loan amount of Rs 30 lakh, then your principal amount is Rs 30 lakh. The interest for your loan amount is fixed by the bank. In the initial years of your loan repayment, the interest amount will be higher and will correspondingly reduce over time. But, if you plan to invest in SIP for home loans, you can recover the interest amount charged on home loans.

SIP Mutual Funds allows investors to deposit a small amount as low as Rs 500 every month or every quarter. With an appropriate mutual fund scheme and investment in SIP, they will allocate your funds in debt or equity, based on your plan.

An easy way to get the cost of interest estimation for your home loan is to use our EMI calculator. When you discover the amount, you can easily choose a SIP Mutual scheme that will help you gain excellent returns to pay your home loan interest. So, while you are planning to take a home loan, don't miss out on investing in SIP and completing your repayment in a hassle-free way.

DISCLAIMER

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.